Updated 3/6/2025

Private school choice is once again shaping up to be a major policy battleground in state legislatures in 2025. Lawmakers in multiple states are pushing to expand publicly funded private school options through vouchers, education savings accounts (ESAs), and tax-credit scholarships, while others seek to scale back or modify existing programs.

Heading into this legislative session, 33 states had some form of private school choice, with 12 offering universal eligibility regardless of family income. More states are now moving to join that list.

[See more: legislation from 2023 and 2024]

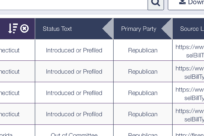

In total, FutureEd has identified 98 bills in 29 states introduced so far this year that aim to expand, revise, or limit private school choice. Three have already been enacted:

- Idaho launched its first private school choice program through a refundable tax credit. Families can receive up to $5,000 per child for private educational expenses, with $7,500 available for students with disabilities. The program is capped at $50 million annually and prioritizes families earning up to 300 percent of the federal poverty level (about $96,450 for a family of four).

- Tennessee passed the Education Freedom Act of 2025, creating a universal ESA program. Families receive $7,000 per student, which must first be used for tuition but can also cover other educational expenses. The program starts with 20,000 scholarships, with half reserved for students from families earning up to 300 percent of the free and reduced-price lunch threshold (about $178,400 for a family of four) and students with disabilities. If at least 75 percent of scholarships are awarded, the cap will rise to 25,000 students in 2026.

- Wyoming passed HB 199, expanding its ESA program by removing income restrictions and making it fully universal starting in 2025-26. Renamed the Steamboat Legacy Scholarship, the program will provide families with $7,000 and be funded through a $30 million appropriation. Participating students must be assessed on academic progress.

Several states are advancing new programs, many of which would allow universal eligibility:

- Illinois lawmakers introduced HB 2822, which would establish an ESA program for families earning up to 2.5 times the free-and-reduced-price lunch income threshold (about $148,700 for a family of four), with awards based on income, up to 100 percent of per-pupil state aid to schools.

- Kansas’s SB 75 proposes a universal refundable tax credit of up to $8,000 per child for tuition at accredited private schools and $4,000 for non-accredited ones. The program starts with a $125 million cap in 2025, increasing annually if participation meets set thresholds.

- Mississippi’s HB 1433 would create an ESA for students in “D” and “F” rated school districts, funded with their portion of per-pupil state aid. The bill would also allow students to transfer to higher-performing public schools if space is available.

- Ohio’s SB 68 would create an ESA program for students attending nonchartered private schools. Currently, only students in chartered private schools, which must follow public school regulations, qualify for Ohio’s choice programs. Amounts would be tiered by income, up to 100 percent of per-pupil state aid to schools.

- Texas legislators introduced SB 2 to create a universal ESA program with a $1 billion appropriation. Families would receive $10,000 annually for tuition or other approved expenses, with additional funding for students with disabilities. Homeschool students would receive $2,000. If demand exceeds funding, priority would go to students with disabilities and families earning below 500 percent of the federal poverty level (about $160,750 for a family of four).

Some states are looking to revise or expand their existing private school choice programs:

- Indiana lawmakers introduced HB 1636 to expand existing choice scholarships by creating “dynamic choice scholarships,” which would allow families to use funds for educational expenses beyond tuition.

- New Hampshire lawmakers introduced SB 295 and HB 115 to remove income restrictions from the Education Freedom Accounts program, making the ESA program universal. SB 296 would eliminate income limits for the state’s tax-credit scholarships while increasing the percentage of awards reserved for low-income students from 40 percent to 50 percent.

- South Carolina’s SB 62 would revise the Education Scholarship Trust Fund program, which was ruled unconstitutional by the state Supreme Court. The bill removes income and public-school attendance restrictions and instead phases in universal eligibility over three years, with lower-income families receiving a priority application window. Scholarships start at $6,000 per student and adjust annually based on state aid.

At the same time, Democratic lawmakers in several states are pushing for stronger oversight of private school choice programs:

- Arizona’s HB 2885 would limit private school tuition increases for ESA recipients to the inflation rate, require schools to report graduation and chronic absenteeism rates, and mandate services for students with disabilities. It also specifies that evaluations for special accommodations must be funded through ESA accounts rather than by school districts. HB 2889 would introduce stricter financial oversight by requiring private schools to disclose the same financial data as public and charter schools, undergo regular audits, and participate in a new financial transparency dashboard.

- Iowa lawmakers have introduced several bills, including SF 199, which would repeal the state’s universal ESA program. HF 359 would require tax statements to disclose ESAs’ financial impact on public school funding and HF 168 would mandate that private schools inform parents about public school services unavailable in nonpublic institutions.

- Tennessee lawmakers introduced several bills, including SB 1132 that would require ESA students to take state assessments and SB 1180 that would mandate background checks for educators. SB 1249 is more comprehensive, requiring state assessments, published lesson plans and other academic information, and mandatory teacher licensure.

We will continue to monitor and update the tracker as new bills are introduced and progress through the legislative process.