The United States has a long history of racially discriminatory policies and practices. Among them was redlining, the refusal of loans, insurance or other resources to people of color, ostensibly because they lived in neighborhoods deemed to be a poor financial risk.

In a new research paper, Harvard University researchers Dylan Lukes and Christopher Cleveland link redlining by the Home Owners’ Loan Corporation (HOLC) between 1935 and 1940 to challenges that schools in formerly redlined neighborhoods face today.

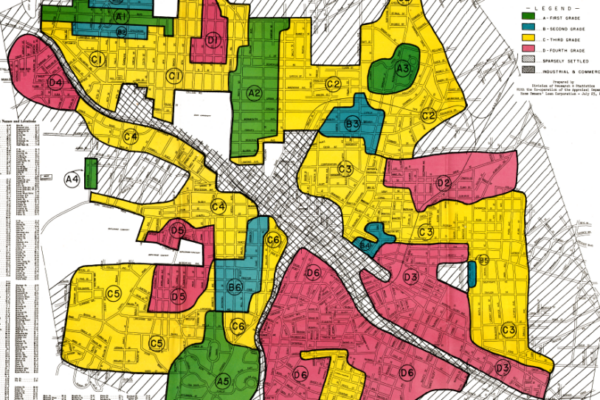

The researchers use recently digitized maps from 1935 to 1940 and data from the National Center for Education Statistics to analyze district-level financing and school-level racial diversity, revealing that schools and school districts in neighborhoods given HOLC’s lowest ratings today have high concentrations of students of color, lower per-pupil spending on the district level, and lower average test scores relative to schools in more highly rated neighborhoods. At the same time, the schools in the redlined neighborhoods do haver higher state and federal revenues, particularly federal Title I dollars for schools with concentrated poverty.

These results point to a need for policymakers to consider the historical implications of neighborhood inequality on present-day neighborhoods when designing strategies to improve education opportunities and outcomes for students of color and those living in poverty.

-By Gunjan Maheshswari