The Supreme Court has handed down a ruling that would effectively allow more public dollars to be used for tuition at religiously affiliated K-12 schools. In the 5-4 decision in Espinoza v. Montana Department of Revenue, the justices ruled that state laws that prohibit spending public dollars on religious schools “discriminated against religious schools and the families whose children attend or hope to attend them in violation of the free exercise clause.”

U.S. Secretary of Education Betsy DeVos put a finer point on it, declaring in a statement: “Religious discrimination is dead.”

The ruling comes as DeVos is pushing her school choice agenda amid significant uncertainties due to coronavirus. Most recently, she released guidance allowing federal stimulus funding to go to private schools—later clarifying that districts could decide to share the federal aid only with private schools serving low-income students.

Some 500,000 students attend private schools under publicly funded tuition vouchers or tax-credit scholarships that provide full or partial state tax credits for those who donate to organizations that provide private school scholarships. In the opinion, Chief Justice John Roberts makes clear that states don’t have to give tuition money to private schools. “But once a State decides to do so, it cannot disqualify some private schools solely because they are religious,” he wrote.

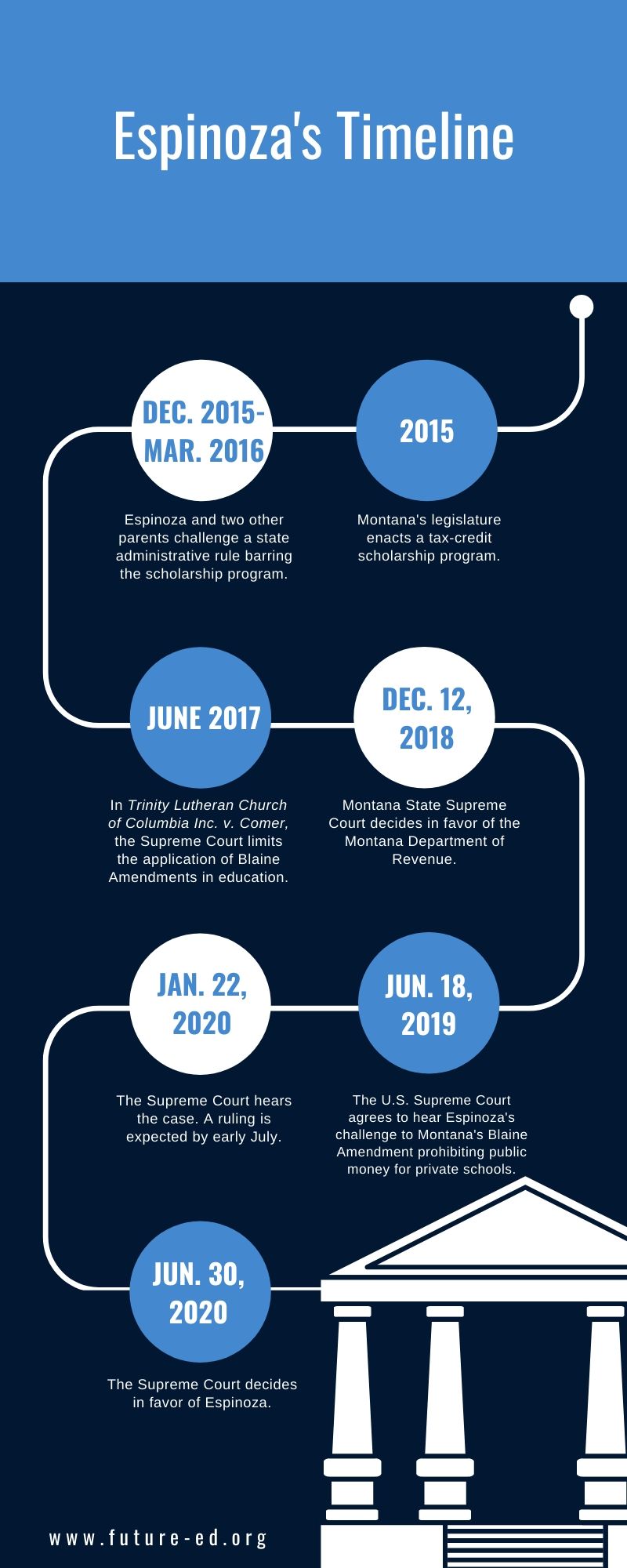

Montana lawmakers in 2015 passed legislation making Montana one of 18 states to permit such tax credits. The following year, the state’s executive branch issued an administrative rule barring tax-credit scholarships from being used at religiously affiliated schools, citing the Montana constitution’s Blaine Amendment’s prohibition of public dollars from directly or indirectly financing such organizations. The Supreme Court is hearing a challenge to the state’s action in Espinoza v. Montana Department of Revenue.

Montana is one of the 37 states with Blaine amendments in their constitutions, named for Congressman James G. Blaine, who in 1875 proposed an unsuccessful amendment to the Constitution prohibiting the use of public funds to support sectarian schools. The Supreme Court ruled in Trinity Lutheran Church of Columbia Inc, v. Comer in 2017 that Missouri’s Department of Natural Resources unconstitutionally denied playground materials to a religiously affiliated preschool. The narrow ruling struck down the power of Blaine Amendments in certain education contexts—rather than striking them down entirely. The question is whether the justices will go further in Espinoza.

The ruling could have a profound effect in Montana and other states that prohibit voucher dollars for religious schools. Nearly 70 percent of Montana’s private schools are religiously affiliated. Kendra Espinoza used a tax-credit scholarship to enroll a child at Stillwater Christian School in Kalispell, Mont. She and the other parents sued the state in the wake of the administrative ruling. The state Supreme Court reversed a lower court ruling and agreed with the state’s Department of Revenue that the tax-credit scholarship program is unconstitutional.

Hoping for a broader win, school choice advocacy organizations such as the Alliance for Choice in Education and EdChoice are filing amici curiae—‘friend of the court’—briefs in support of Espinoza and the other plaintiffs. Teacher advocacy organizations, like the Tennessee Education Association, also filed briefs in support of the state.